Medicare Supplement Plans Comparison Chart

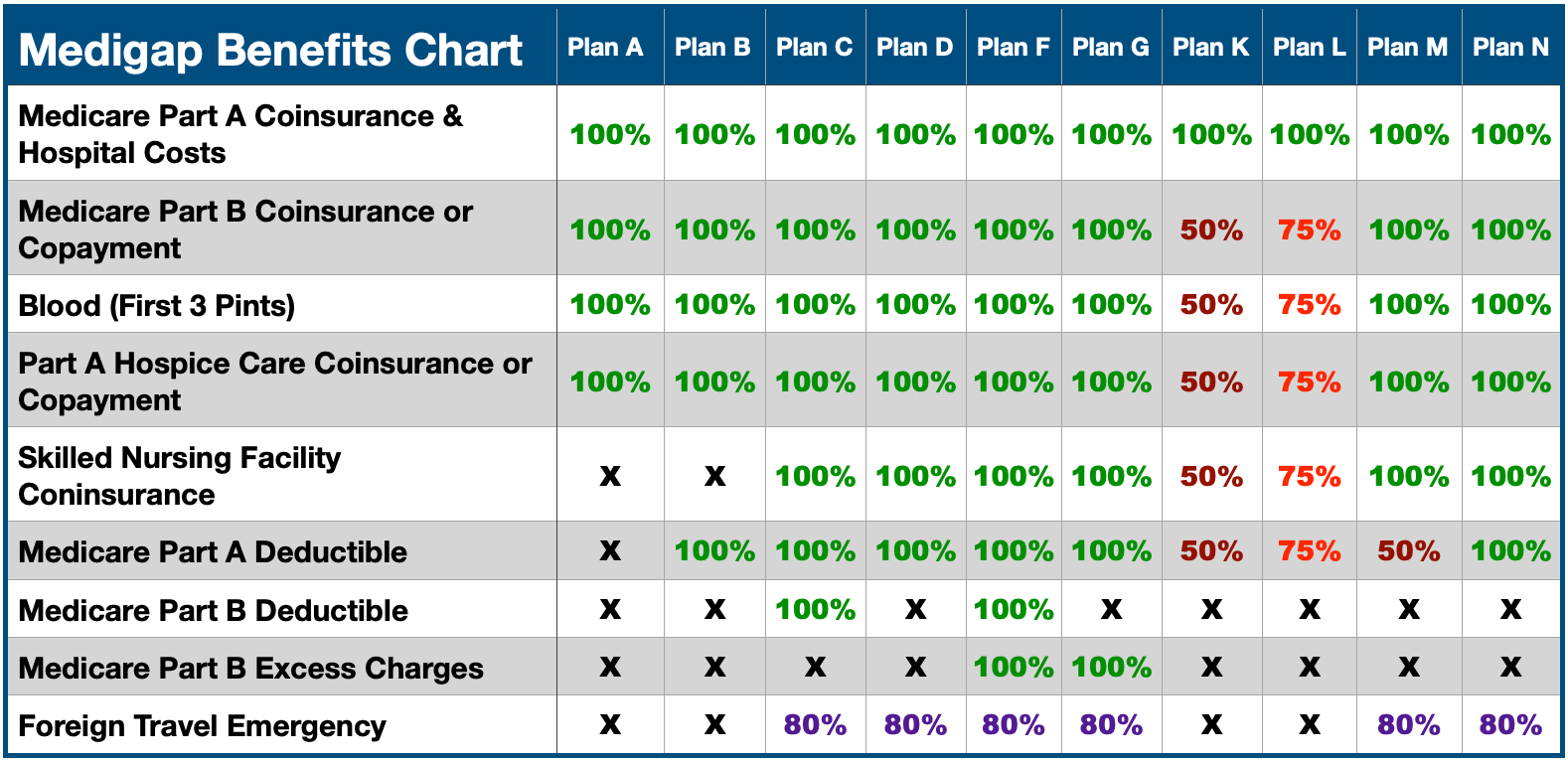

The Medicare Supplement Plans Comparison Chart is updated annually by Medicare.gov . Our Medigap Benefits Chart uses data from Medicare.gov and is up-to-date for 2024.

Federal and State laws make it easy to compare Medicare Supplement plans. Medicare law says companies must identify Medigap Plans by letter. If you were eligible for Medicare before 2020, you could have bought any of these ten Medicare Plans: A, B, C, D, F, G, K, L, M, and N.

However, people newly eligible for Medicare starting January 1, 2020, could only buy one of these eight Medicare Plans: A, B, D, G, K, L, M, and N. In other words, people who enroll in a Medicare Supplement plan in 2024 will not be allowed to get Plans C or F. Moreover, the most comprehensive Medigap Plans available for you are Plan G and Plan N.

Unsure which plan is right for you? Senior Healthcare Direct can help you compare Medicare Supplement, aka Medigap plans. Our highly experienced and licensed agents can help you determine which plan is right for your specific needs based on your circumstances. Let us provide a personalized Medicare Supplement comparison to help determine which level of care and coverage works for your needs and budget. Reach out to us today to compare Medicare Supplement plans. We’re happy to help!

Medicare Supplement Plans Comparison Chart

You can use the Medigap Benefits chart for a side-by-side comparison of Medicare Supplement Plans A – N. Plans with 100% provide full benefit coverage. However, some plans only have partial benefit coverage, such as 80%, 75%, and 50%.

Plans with X do not cover that particular benefit. If you were newly eligible for Medicare starting on or after January 1, 2020, then Plan C and Plan F are not available to you. However, beneficiaries who had Plans C or F before 2020 can keep them. A personalized Medigap plan comparison is always better – let us help you compare policies.

NEW OUT-OF-POCKET LIMITS ON PLAN K AND PLAN L

In 2023, the maximum out-of-pocket limit for Plan K has increased by $320. The new Plan K out-of-pocket limit is $6,940. Likewise, the maximum out-of-pocket limit for Plan L has increased from $3,310 in 2022 to $3,470 in 2023.

Foreign Travel Emergency Benefits

Medigap Plans with the most comprehensive coverage, including Plans F, G, and N, have foreign travel emergency benefits. You can also get these benefits with Medicare Supplement Plans C, D, and M. However, Plans A, B, K, and L, do not provide foreign travel emergency benefits.Medicare may provide foreign travel coverage under certain situations when traveling outside the United States. If you do not meet these particular circumstances, then Medicare will not cover foreign travel.

YM03182201 and YM06022301