The Four Parts of Medicare Explained

Each part of Medicare covers different services as explained below:

- Part A Covers Inpatient Hospital Services.

- Part B Covers Outpatient Medical Services.

- Part C Is A Medicare Advantage Plan Offered By Private Companies Approved By Medicare, And Cover Part A And Part B Services.

- Part D Provides Prescription Drug Coverage To Lower The Cost You Pay For Medications.

Different Parts Of Medicare Explained

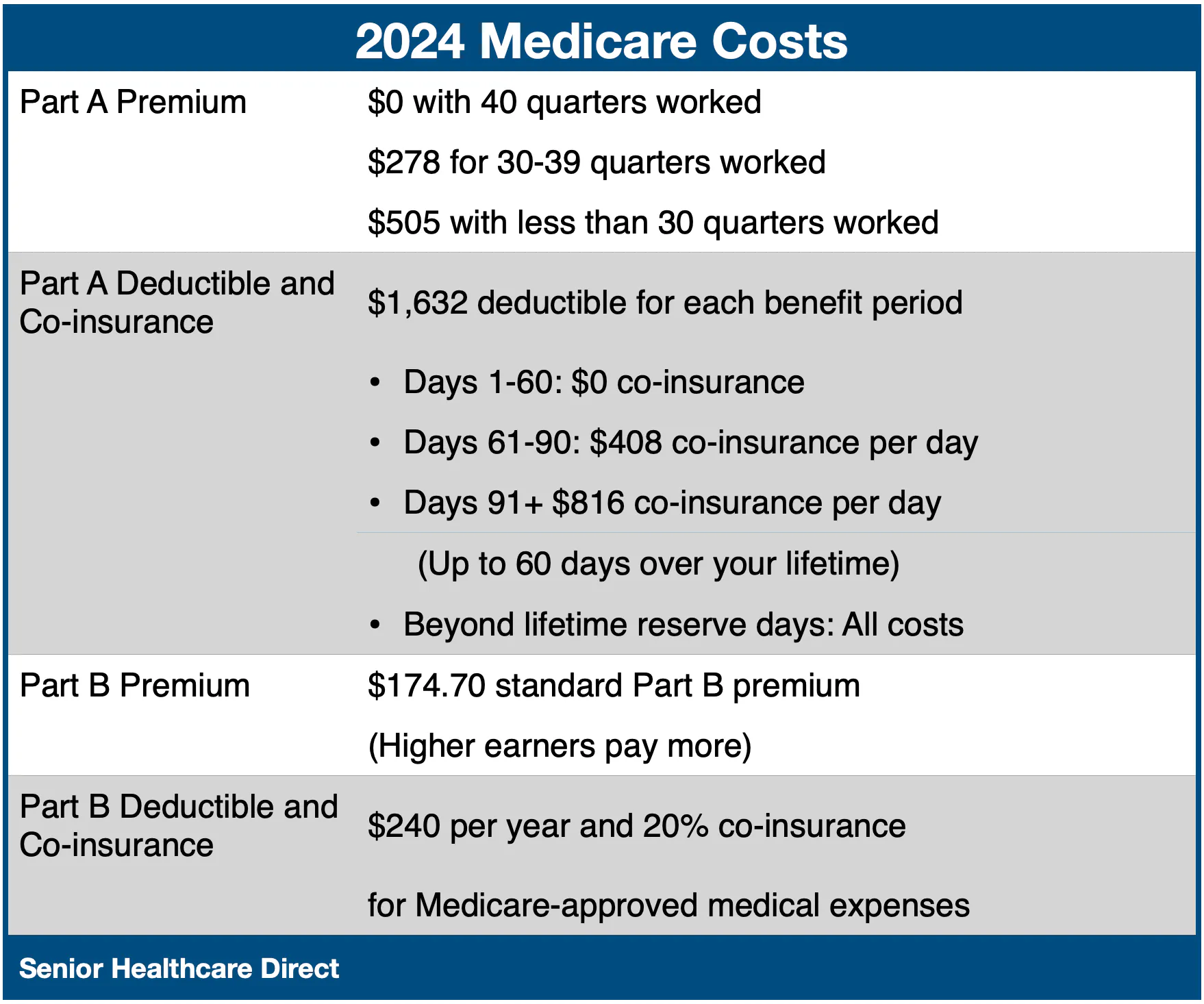

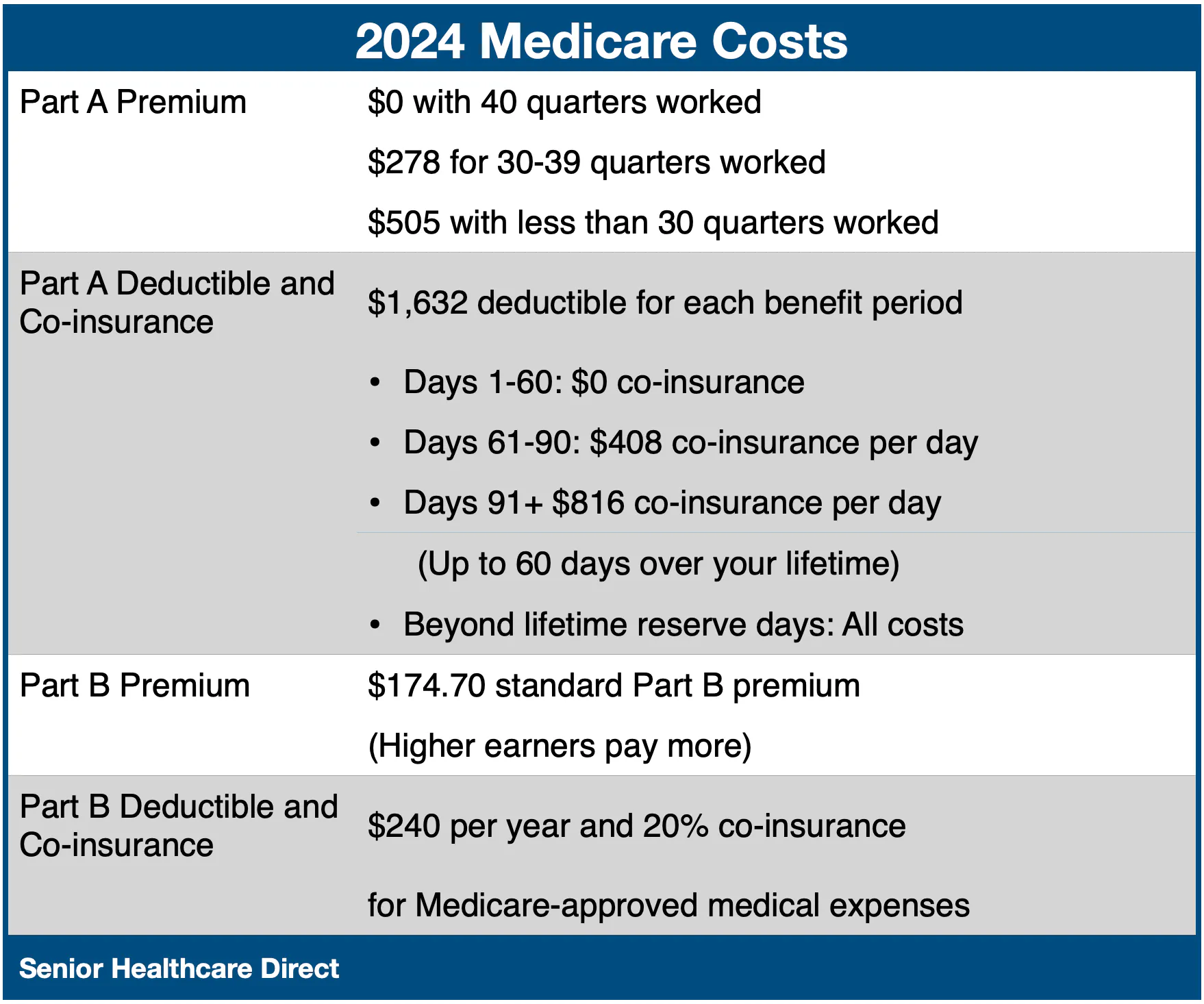

The premium cost of Medicare Part A depends on the number of quarters you worked. Most people have worked 40 quarters or more, so the Part A premium cost is zero. The Part A deductible is $1,632 in 2024 for each benefit period of 60 days or less.

For example, you become a hospital inpatient on January 1, 2024, and pay a $1,632 deductible. Then, 60 days later, on March 2, 2024, a doctor admits you as a hospital inpatient. You pay the $1,632 deductible again. Therefore, in the worst-case scenario, a Medicare beneficiary goes in and out of the hospital six times per year and pays a maximum of $9,792 total in Part A deductibles.

To avoid the expensive cost of multiple hospitalizations, you could buy a Medicare Supplement Plan by calling Senior Healthcare Direct and speaking with a licensed agent at 1-833-463-3262, TTY 711, or get your quote.

Wondering about the difference between Medicare Part A and B? Medicare Part B covers the following services:

Medicare Part B covers the following services:

Medical outpatient services

Preventive services

Medicare outpatient coverage includes:

Ambulance Service

Doctor Visits

Mental Health

Durable Medical Equipment

Medicare preventive coverage includes:

Preventive screening tests that help detect health conditions at early stages when treatment is most effective. If you qualify, you may pay nothing for the following:

Nutrition Therapy Service

“Welcome to Medicare” preventive visit

Yearly Wellness Visit

Medicare Part C is an alternative to Original Medicare and covers Part A (Hospital Insurance) and Part B (Medical Insurance). Part C is also known as a Medicare Advantage (MA) plan.

MA plans often include Medicare Part D prescription drug coverage. Moreover, many MA plans include extra benefits not covered by Original Medicare. For example, MA plans may include dental, vision, and hearing. Some MA plans even include gym memberships such as Silver Sneakers! MA plans are offered through a network of healthcare providers HMO or PPO.

To enroll in Medicare Advantage plan (Part C) you must first be enrolled in Part A and Part B. Most Medicare beneficiaries pay no premium for Part A. However, beneficiaries new to Medicare will have to pay Part B monthly premiums. Furthermore, you may need to pay a monthly Part C premium.

Part D saves you money on prescription drugs. Specifically, it reduces your cost for brand-name and generic drugs. For example, rather than paying the full retail price for medications, you only pay small copayments with Part D.

You must have either Part A or Part B to join a stand-alone Part D drug plan with Original Medicare. However, you must have both Part A and Part B to join a Medicare Advantage (Part C) plan.

All stand-alone Part D drug plans have a monthly Part D premium. The amount you pay in 2023 depends on the income reported on your 2021 tax return. Some Part D plans have an annual deductible which can not be more than $545 in 2024. However, other drug plans may have little or no deductible.

After the out-of-pocket deductible, you pay either a copay or coinsurance for each prescription drug. For example, you may pay less for drugs in tier 1 and more for drugs in tier 2.

In 2024, you enter the donut hole after you and your plan spend $5,030. Then, you pay no more than 25% coinsurance for the plan’s covered brand-name and generic prescription drugs. After total out-of-pocket drug costs are $8,000, you exit the donut hole.

Medicare Part A

Medicare Part B

Wondering about the difference between Medicare Part A and B? Medicare Part B covers the following services:

Medicare Part B covers the following services:

Medical outpatient services

Preventive services

Medicare outpatient coverage includes:

Ambulance Service

Doctor Visits

Mental Health

Durable Medical Equipment

Medicare preventive coverage includes:

Preventive screening tests that help detect health conditions at early stages when treatment is most effective. If you qualify, you may pay nothing for the following:

Nutrition Therapy Service

“Welcome to Medicare” preventive visit

Yearly Wellness Visit

Medicare Part C

Medicare Part C is an alternative to Original Medicare and covers Part A (Hospital Insurance) and Part B (Medical Insurance). Part C is also known as a Medicare Advantage (MA) plan.

MA plans often include Medicare Part D prescription drug coverage. Moreover, many MA plans include extra benefits not covered by Original Medicare. For example, MA plans may include dental, vision, and hearing. Some MA plans even include gym memberships such as Silver Sneakers! MA plans are offered through a network of healthcare providers HMO or PPO.

To enroll in Medicare Advantage plan (Part C) you must first be enrolled in Part A and Part B. Most Medicare beneficiaries pay no premium for Part A. However, beneficiaries new to Medicare will have to pay Part B monthly premiums. Furthermore, you may need to pay a monthly Part C premium.

Medicare Part D

Part D saves you money on prescription drugs. Specifically, it reduces your cost for brand-name and generic drugs. For example, rather than paying the full retail price for medications, you only pay small copayments with Part D.

You must have either Part A or Part B to join a stand-alone Part D drug plan with Original Medicare. However, you must have both Part A and Part B to join a Medicare Advantage (Part C) plan.

All stand-alone Part D drug plans have a monthly Part D premium. The amount you pay in 2023 depends on the income reported on your 2021 tax return. Some Part D plans have an annual deductible which can not be more than $545 in 2024. However, other drug plans may have little or no deductible.

After the out-of-pocket deductible, you pay either a copay or coinsurance for each prescription drug. For example, you may pay less for drugs in tier 1 and more for drugs in tier 2.

In 2024, you enter the donut hole after you and your plan spend $5,030. Then, you pay no more than 25% coinsurance for the plan’s covered brand-name and generic prescription drugs. After total out-of-pocket drug costs are $8,000, you exit the donut hole.

When Does Medicare Coverage Start?

Medicare coverage may start the first day of the month you turn 65. For example, if your birthday is 10/10/1948, your Medicare will start 10/01/2013. However, if your birthday is on the first of the month, your Medicare will start a month before your birth month on the first. For instance, if your birthday is 10/01/1948, then your Medicare will start 09/01/2013.

You may have a different Medicare start date if you delay Medicare coverage. Learn when you can sign up for Medicare.

How Do I Pay For Medicare?

Discover the easy way to pay your Medicare premiums. Medicare Easy Pay is a free, electronic payment option. It automatically deducts your Medicare premium from your bank account each month. In other words, it automatically pays your Medicare premiums every month and removes the burden of you paying it yourself.

What Is Medicare Coinsurance?

Coinsurance is your share of insurance costs after you pay the deductible. For Medicare Parts A and B, your coinsurance cost is 20%. If you receive inpatient mental health services, you pay 20% coinsurance. In addition, hospital copays are due after 60 days.

Hospital Copays In 2024

First 60 days, your copay is $0

Days 61 – 90, your copay is $408/day

Days 91+, your copay is $816/day

What Is A Medicare Deductible?

Medicare deductible is an amount of money that you are required to pay before your insurance plan will pay anything towards your bills.

Deductible Examples

Medicare Part A has a $1,632 deductible when you go to the hospital in 2024. This means you pay the first $1,632 before Medicare Part A pays.

Medicare Part B has an annual deductible of $240 in 2024. You must pay the first $240 of your medical and doctor bills before Medicare pays.

Common Questions About Medicare Parts Explained

What Is My Medicare Claim Number?

Your Medicare Claim Number used to be your social security with a letter after it. However, your social security number on Medicare cards were replaced with a new Medicare Number to prevent identify theft and taxpayer fraud.

Each new Medicare Number is unique to each beneficiary, has 11 characters, and composed of numbers and uppercase letters. It excludes the letters (S, L, O, I, B, Z) which could be interpreted as numbers.

Is Medicare Free?

If you paid Social Security Tax for at least 40 quarters (10 years) and your net earnings equaled the yearly maximum of 4 credits, you pay no Medicare Part A premiums.

However, Medicare Part B has a premium based on your income from the prior two years. The standard Part B premium is $174.70 in 2024.

What Is Not Covered By Medicare Part A And Part B?

The following is not covered by Medicare Part A and Part B: Long-term care, Routine dental or eye exams for glasses, dentures, cosmetic surgery, hearing aids/ exams, massage therapy, and routine physical exams.

Still have questions relating to “What are Medicare parts?” Senior Healthcare Direct can help you shop for the right Medicare plan. Speak with a licensed agent at 1-833-463-3262.