What Is Medicare Supplement Plan K?

Medicare Supplement Plan K pays 100% of Part A coinsurance. However, it only pays 50% of other benefits. Plan K is one of 10 Medigap plans and one of just two with an annual out-of-pocket limit. Medigap plans help pay for healthcare costs not covered under Original Medicare (Part A and Part B). To obtain Medicare Plan K coverage, you must be enrolled in original Medicare.

In 2024, the maximum out-of-pocket limit for Plan K increased to $7,060.

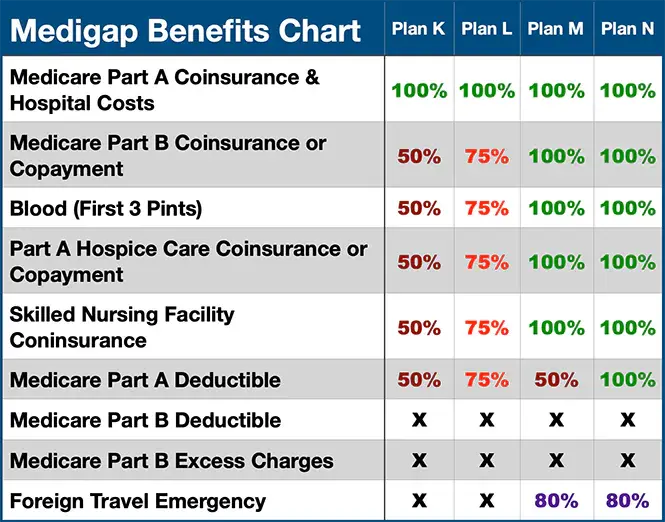

Medicare Plan L Vs Plan K

Medicare Plan L pays 100% of Part A coinsurance and 75% of other benefits. Plan L’s max out-of-pocket (MOOP) is $3,530 in 2024.

In comparison, Plan K’s MOOP is double the cost of Plan L and pays 50% of other benefits.

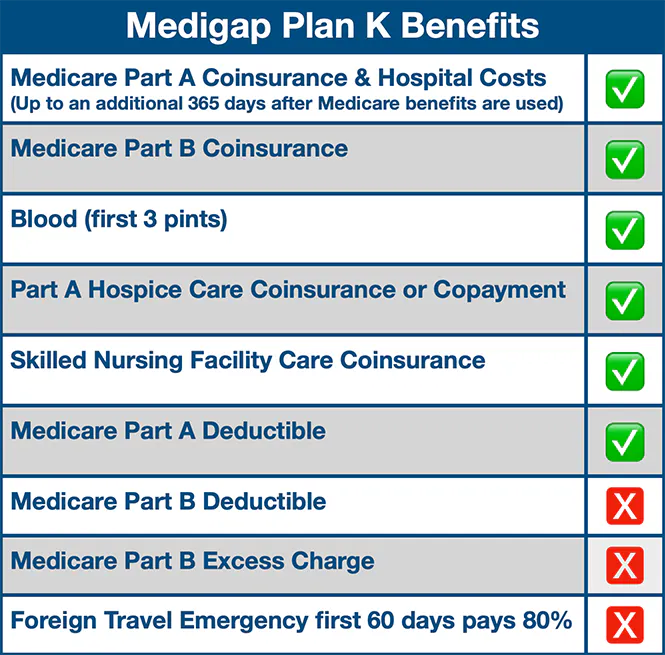

What Does Medigap Plan K Cover?

What can Medicare Plan K do for you? Medicare Supplement Plan K benefits include coverage for Part A (which covers hospital insurance) and Medicare Part B (which covers outpatient medical needs). It includes the following benefits:

Medicare Part A coinsurance and hospital care

50% of Medicare Part B coinsurance and copayment

50% Blood Costs (first 3 pints only)

50% of Part A Hospice care coinsurance

50% of Medicare Part A deductible, which is $1,632 in 2024

50% of skilled nursing care coinsurance

How Does Medicare Plan K Compare To Other Plans?

What is Medicare Supplement Plan K able to do for you that other plans cannot? In short, all Medigap policies are standardized. All must follow federal and state laws designed to protect the insurance holder. Like all other Medigap plans, Plan K covers Part A coinsurance and hospital coverage. It pays 50% of Part B coinsurance or copayment, while Plan L covers 75% of this cost and Plan M and N cover it fully. It also covers 50% of blood, Part A hospice care coinsurance or copayment, skilled nursing facility care coinsurance, and Part A deductible. By comparison, Plan L covers these at 75%. Also, Plan K has a higher out-of-pocket limit than Plan L, which may be beneficial to some people. Unlike Plan M and Plan N, Plan K does not provide any coverage for foreign travel exchange.Who Is Eligible For Medicare Plan K?

Individuals must have Original Medicare in place to obtain Medicare Plan K. That includes Part A and Part B. You’ll need to meet all the requirements for this before you can enroll in Plan K. If you have not signed up just yet, you can apply or learn how to apply for Medicare. Do this during your 7-month Initial Enrollment Period. You may be first eligible to obtain Medicare when you turn 65. However, if you did not sign up at that age, you can do so during the General Enrollment Period from January 1 through March 31.Medicare Initial Enrollment Period

When you enroll in Medicare outside of your 7-month Initial Enrollment Period, Medicare Supplement insurance companies will ask you health questions. Moreover, Medigap insurance underwriting can deny coverage based on health conditions. Furthermore, the Medigap insurance provider may charge you more based on the underwriting interview. Thus, the best time to buy a Medigap plan is when you first become eligible.

How Can Senior Healthcare Direct Help You?

Our licensed agents work with seniors to help them understand all the complexities of Medicare, including Part K. They also provide extensive support to help you choose the best plan based on your circumstances. Let us help you find the right supplement plan.YM04152202 and YM06022304