What Does Medicare Plan G Cover?

Medicare Plan G is a Medicare Supplement plan that may provide greater value than Plan F. It provides you the same full coverage benefits of Medicare Plan F with a lower monthly premium. When you get an affordable Plan G versus Plan F, you could save $500 or more per year in premiums.

The only difference between Plan F and G is that Plan G requires you to pay the Medicare Part B annual deductible. In 2024, the Part B deductible is only $240. In other words, after you spend $240, you could save $260 or more in annual premiums.

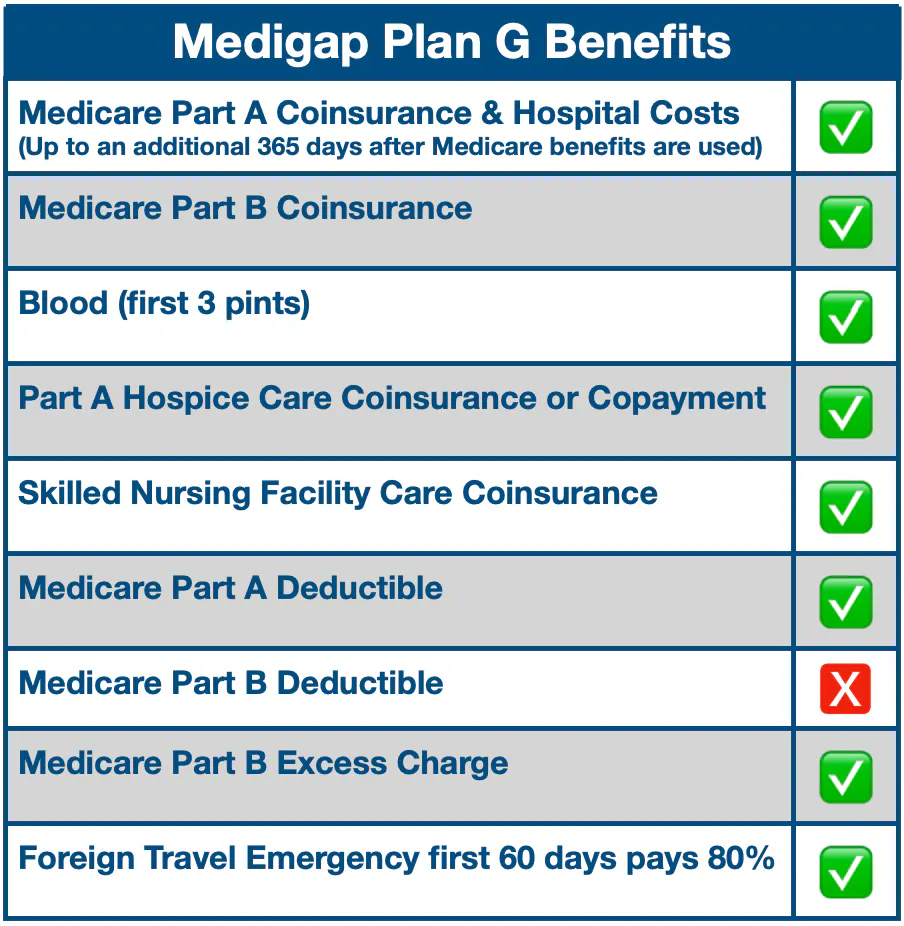

What is another name for Medicare Supplement Plan G? It’s also called Medigap Plan G. A Medigap plan covers some or all of your out-of-pocket Medicare costs. For example, Plan G covers all your Medicare coverage gaps except the Part B deductible.

What Does Plan G Cover?

Why Medicare Plan G Is Better Than Plan F

Medicare Plan G is a better value than Plan F for several reasons. First, Plan G has lower monthly premiums than Plan F. Second, over the years, Medigap Plan G premium rates have

increased less than Plan F. Thus, lower premiums make Plan G a better value than Plan F.

Robert Bache, the founder of Senior Healthcare Direct, has correctly predicted Plan G to be a better value than Plan F. Furthermore, he continues to recommend Plan G.

In recent years, Medicare Plan G has sometimes increased as little as 3% with some carriers. In comparison, Plan F during the same time has increased significantly more.

Medicare Part B: Outpatient Medical Coverage and Cost

Plan G covers Medicare Part B outpatient medical services at any hospital or medical facility for less than 24 hours. Furthermore, Plan G covers outpatient preventive services, such as diabetes self-management training. Moreover, Plan G covers the following:

When you have moderate or severe COPD, Plan G pays your 20% coinsurance that you would otherwise have to pay.

After you pay the $240 Part B deductible in 2024, Plan G can pay your 20% coinsurance cost.

If you have a diabetic condition, Plan G pays 20% coinsurance costs for therapeutic shoes and inserts.

Medicare Plan G Case Study: A Great Value

With Plan G coverage, George does not have to worry about any doctor copays. He will not pay for ambulance transportation, lab-work or imaging. If George has surgery, Medicare will cover 80% and his Plan G will cover the other 20%.

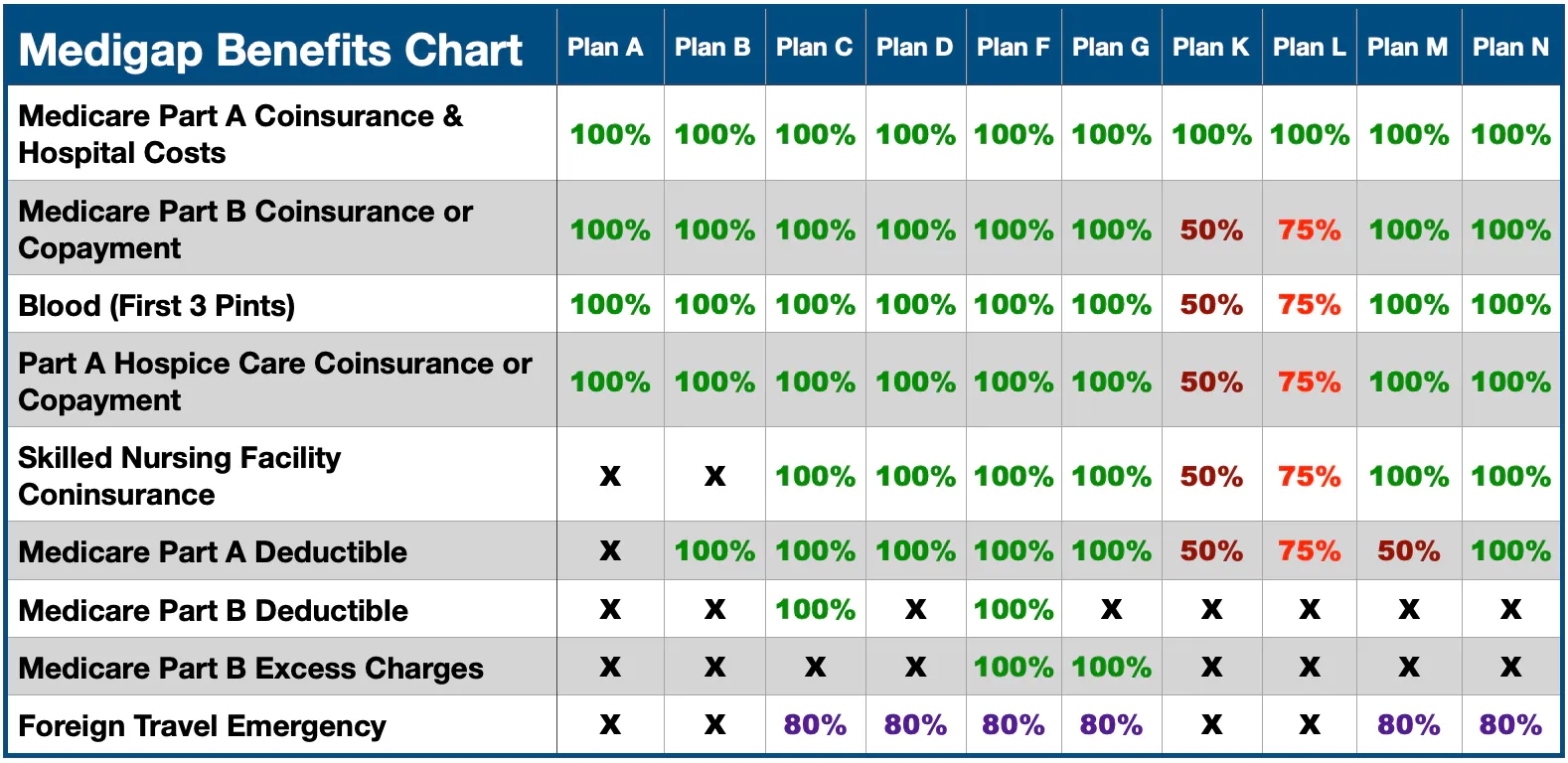

Plan G is a great value for George. Depending on your needs, Plan G might be right for you, as well. To help you decide which supplement plan is best for you, review the Medigap Benefits Chart for a side-by-side comparison of all Medigap Plans.

With Plan G coverage, George does not have to worry about any doctor copays. He will not pay for ambulance transportation, lab-work or imaging. If George has surgery, Medicare will cover 80% and his Plan G will cover the other 20%.

Plan G is a great value for George. Depending on your needs, Plan G might be right for you, as well. To help you decide which supplement plan is best for you, review the Medigap Benefits Chart for a side-by-side comparison of all Medigap Plans.

Medicare Supplement Plans Comparison Chart

You can use the Medigap Benefits chart for a side-by-side comparison of Medicare Supplement Plans A – N. Plans with 100% provide full benefit coverage. However, some plans only have partial benefit coverage, such as 80%, 75%, and 50%.

Plans with X do not cover that particular benefit. If you were newly eligible for Medicare starting on or after January 1, 2020, then Plan C and Plan F are not available to you. However, beneficiaries who had Plans C or F before 2020 can keep them. A personalized Medigap plan comparison is always better – let us help you compare policies.

Linda’s Story

Linda’s doctor admits her to a hospital as an inpatient for 36 days. On day one, Linda pays her $240 Part B deductible. Then, she starts receiving skilled nursing care. Linda receives a semi-private room, meals, and skilled nursing to treat, manage, and observe her condition.

Medicare Plan G pays her Part A deductible of $1,632 for her first 20 days. Then, Plan G covers days 61 to 90 at $408 coinsurance per day for a 30-day benefit of $12,240.

After her doctor discharged her from the hospital, she required outpatient physical therapy. Linda’s physical therapist accepted Medicare but decided not to accept the Medicare-approved amount for her physical therapy. Therefore, the physical therapist charged Linda 15% more than Medicare’s approved amount. Fortunately, Linda had Medicare Plan G, which covered this Part B excess charge.

Senior Healthcare Direct

Common Questions About Medicare

What is the Medicare Supplement Plan G deductible?

$240 is the annual Part B deductible in 2024, which you pay for Plan G.

What does Medicare

Plan G pay for?

Plan G pays for your hospital deductible. After you pay the $240 deductible in 2024, it pays for your outpatient medical coverage for stays at any hospital or medical facility for less than 24 hours. In addition, Plan G pays for all your copays and coinsurance under Medicare.

Does Medicare Plan G cover dental?

No, neither Medicare nor Medigap plans cover dental care.

Does Plan G cover prescription drugs?

Plan G covers the coinsurance for any Part B prescription drugs. These medications are typically limited to people with specific medical conditions.

Plan G covers chemotherapy drugs, anti-nausea medications, immunosuppressive

medications, and drugs for end-stage renal disease (ESRD).

Medigap Plan G does not cover outpatient retail prescriptions. In this case, you will need a Part D drug plan.

Is Medicare Plan G better than Plan F?

Yes, Plan G can be a better value than Plan F. You pay the $240 Part B annual deductible in 2024 for a monthly benefit of paying a lower Plan G premium versus Plan F. Since you can save several hundred dollars in premiums on Plan G it can be a better value than Plan F.

YM05032301