Medicare Plan F

Has Plan F Gone Away?

Medicare Plan F, also known as Medicare Supplement Plan F or Medigap Plan F, has gone away for people new to Medicare. Plan F is not available for purchase after January 1, 2020.

For example, anyone who turned 65 or had a qualifying disability and enrolled in Medicare in 2021 was not able to purchase Plan F. However, if you had Medicare before 2020, you could still keep it.

Plan F Vs Plan G

Medicare Plan F Vs Plan G

If you become eligible for Medicare in 2024, you cannot enroll in Plan F coverage. In this case, Plan G may be your best option. However, if you switch to a different Medigap Plan, you may have to answer health questions. Consequently, you may not qualify due to health problems.

For example, if you have a pre-existing condition, the supplement company can refuse to cover your out-of-pocket costs for these pre-existing health problems for up to six months. Medicare calls this a “pre-existing condition waiting period.” After six months, the new plan will cover the pre-existing condition.

What Does Medigap Plan F Cover?

Medigap Plan F provides you with full coverage benefits. To be eligible for Plan F coverage, you must first enroll in Medicare Part A and Part B. The Medigap Plan F Benefits chart lists all your benefits, which includes:

Inpatient hospital coverage (Part A) coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

Outpatient medical coverage (Part B) coinsurance and copayment

Skilled nursing facility care coinsurance

First three pints of blood

Foreign travel emergency (first 60 days pays 80%)

Medicare Part A deductible

Medicare Part B deductible

Medicare Part B excess charge

What Medicare Plan F Does Not Cover

It’s also important to know what Plan F supplemental insurance does not cover. It does not cover prescription drugs (that’s covered by Medicare Part D) or any type of supplemental health benefit, such as hearing aids, dental care, long-term care, vision care and others.

What is a Pre-existing Condition?

A pre-existing condition is a health problem that started more than six months before the start of your Medicare policy. For example, if your new plan begins on March 1, 2022, and you had a health problem within the last six months, this is not a pre-existing condition. However, if your doctor treated or diagnosed a health problem more than six months ago, it is a pre-existing condition.

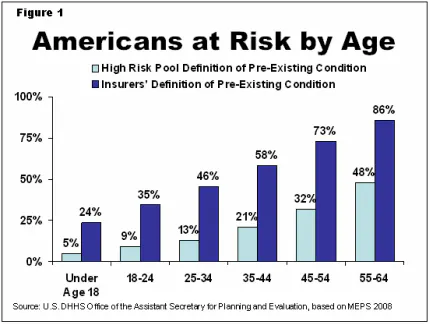

According to CMS.gov , 86% of older Americans, ages 55 to 64, have a pre-existing condition. Because you are very likely to have a pre-existing condition, Medicare says, “The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period.” During this open enrollment period, you can get a Medigap plan without medical underwriting. Thus, Medicare supplement companies can not deny you because of a pre-existing condition.

Why Plan G is a Better Value Than Plan F

Medicare Plan G is a better value than Plan F coverage for several reasons. First, Plan G has lower premiums than Plan F. Furthermore, Plan G’s premiums increase less than Plan F. For example, year after year, Plan G is a better value than Plan F.

In recent years, Medicare Plan G has sometimes increased as little as 3% with some carriers. In comparison, Plan F during the same time has increased significantly more. If you have Original Medicare, find out when you can enroll in a Medigap Plan. For people in a Medicare Advantage Plan, discover when you can switch to a supplement plan.

What Does Medigap Plan F Cost?

Medigap Plan F costs more than Plan G. When shopping rates at Senior Healthcare Direct, you may find a supplement Plan G that saves you $500 or more in premiums over Plan F. In other words, Plan F could cost you $500 or more per year than Plan G.

Furthermore, the only cost difference between Medigap Plan F and G is the $240 Part B deductible with Plan G. Since you could spend $500 less in annual premiums with Plan G, you could save a difference of $260 per year! The monthly premium you pay for Medigap Plan F depends on the following factors:

Geographic location (zip code)

Gender

Tobacco usage

Most insurance carriers give discounts to female, non-tobacco users. Consequently, companies charge more for male tobacco users. However, enrolling two or more people can also get a household discount.

Shop for Medigap Plan F

Common Questions About Medicare

What is Plan F deductible?

$0. Medicare Plan F has no deductible.

What does Medicare Plan F pay for?

Medicare Plan F pays for your Part A hospital deductible and Part B medical deductible. In addition, Plan F pays for all your copays and coinsurance under Medicare.

Does Medicare Plan F Cover Dental, Vision, Hearing?

No, neither original Medicare nor Medigap plans cover dental, vision, or hearing care. These benefits may be available through a Medicare Advantage or stand-alone plan.

Does Medicare Plan F Cover Prescription Drugs?

Plan F covers the coinsurance for any Part B prescription drugs. These medications are typically limited to people with specific medical conditions. Also, Plan F covers chemotherapy drugs, anti-nausea medications, immunosuppressive medications, and drugs for end-stage renal diseases (ESRD). Plan F does not cover outpatient retail prescriptions. For those you need a Part D drug plan.Has Medicare Plan F Gone Away?

Yes. Medicare Plan F has gone away for people newly eligible for Medicare after January 1, 2020.

Is Medicare Plan G Better Than Plan F?

Medicare Plan G may be a better value than Plan F. The monthly premiums you could save may exceed the $240 Part B deductible in 2024.

Let Senior Healthcare Direct Help You Secure the Best Coverage

What is Medicare Plan F? Is it something you should invest in? Let the professionals at Senior Healthcare Direct help you determine if Medigap Part F is available to you and how it may help in your specific situation. Our team can help by comparing several options of coverage to determine if Supplement Plan F fits your situation best. Our goal is to make sure your needs are met and that your coverage is affordable to you. Let us help you find the right coverage for you.

YM03182201 and YM06022303