The Four Parts of Medicare Explained

Each part of Medicare covers different services as explained below:

Part A Covers Inpatient Hospital Services.

Part B Covers Outpatient Medical Services.

Part C Is A Medicare Advantage Plan Offered By Private Companies Approved By Medicare, And Cover Part A And Part B Services.

Part D Provides Prescription Drug Coverage To Lower The Cost You Pay For Medications.

Different Parts Of Medicare Explained

When Does Medicare Coverage Start?

Medicare coverage may start the first day of the month you turn 65. For example, if your birthday is 10/10/1948, your Medicare will start 10/01/2013. However, if your birthday is on the first of the month, your Medicare will start a month before your birth month on the first. For instance, if your birthday is 10/01/1948, then your Medicare will start 09/01/2013.

You may have a different Medicare start date if you delay Medicare coverage. Learn when you can sign up for Medicare.

How Do I Pay For Medicare?

Discover the easy way to pay your Medicare premiums. Medicare Easy Pay is a free, electronic payment option. It automatically deducts your Medicare premium from your bank account each month. In other words, it automatically pays your Medicare premiums every month and removes the burden of you paying it yourself.

What Is Medicare Coinsurance?

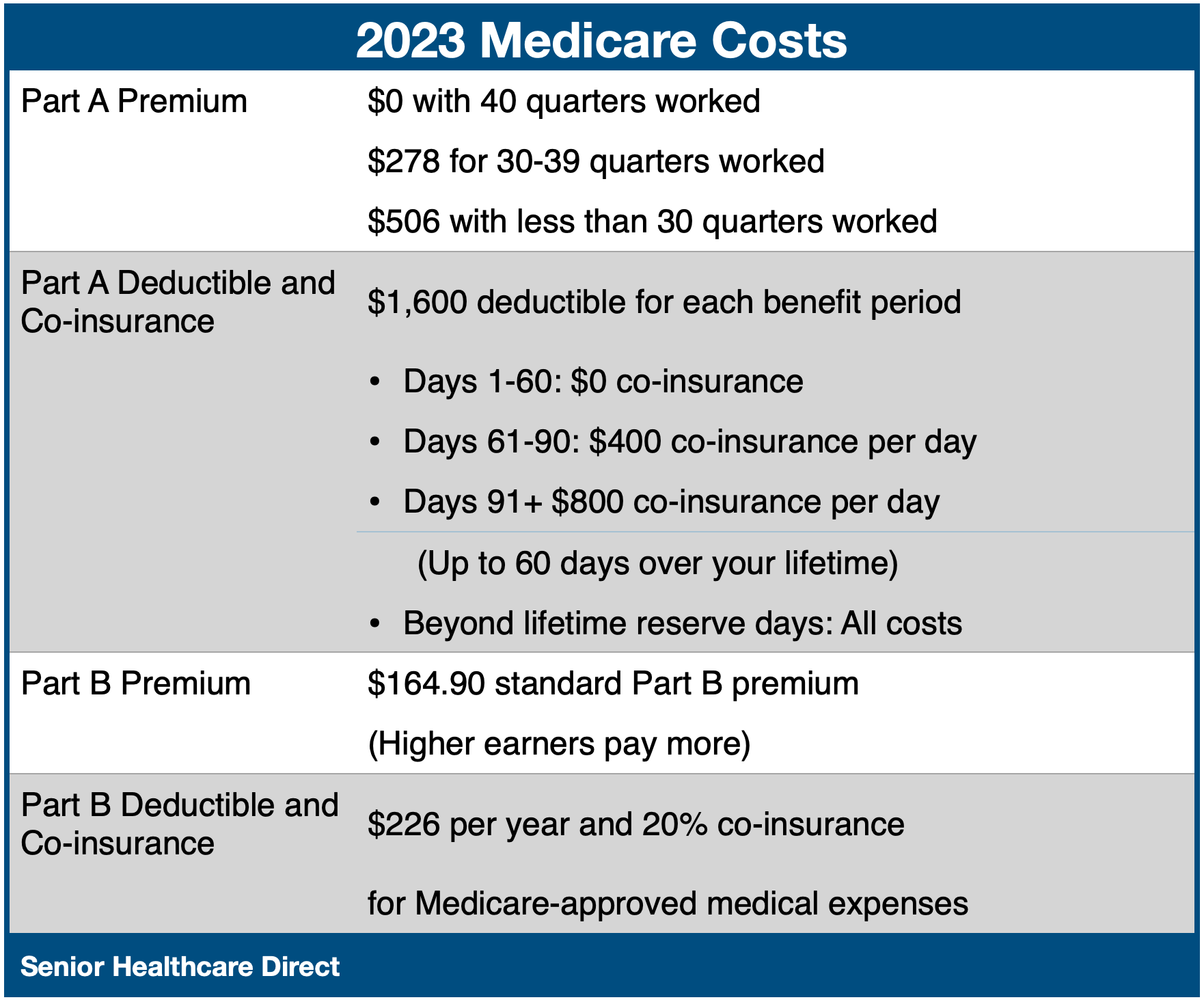

Coinsurance is your share of insurance costs after you pay the deductible. For Medicare Parts A and B your coinsurance cost is 20%. For example, after you pay the Part A deductible you owe 20% of the hospital bill.

Hospital Coinsurance In 2022

First 60 Days Your Coinsurance Is $0.

Days 61 – 90 Your Coinsurance Is $400/Day

Days 91+ Your Coinsurance Is $800/Day

What Is A Medicare Deductible?

Medicare deductible is an amount of money that you are require to pay before your insurance plan will pay anything towards your bills.

Deductible Examples

Medicare Part A has a $1,600 Deductible when you go to the hospital In 2023. This means you pay the first $1,600 before Medicare Part A pays.

Medicare Part B has an annual deductible of $226 in 2023. This means that you have to pay the first $226 of your medical and doctor bills before Medicare pays.

Common Questions About Medicare Parts Explained

What Is My Medicare Claim Number?

Your Medicare Claim Number used to be your social security with a letter after it. However, your social security number on Medicare cards were replaced with a new Medicare Number to prevent identify theft and taxpayer fraud.

Each new Medicare Number is unique to each beneficiary, has 11 characters, and composed of numbers and uppercase letters. It excludes the letters (S, L, O, I, B, Z) which could be interpreted as numbers.

Is Medicare Free?

If you paid Social Security Tax for at least 40 quarters (10 years) and your net earnings amount equaled the yearly maximum of 4 credits, you pay no Medicare Part A premiums.

However, Medicare Part B has a premium is based on your income from the prior two years. The standard Part B premium is $164.90 in 2023.

What Is Not Covered By Medicare Part A And Part B?

The following is not covered by Medicare Part A and Part B: Long-term care, Routine dental or eye exams for glasses, dentures, cosmetic surgery, hearing aids/ exams, massage therapy, and routine physical exams.

Still have questions relating to “what are Medicare parts”? Senior Healthcare Direct helps you shop for the Medicare plan that is best for you. To have the specific Medicare parts explained further, please enter your information below, and a licensed agent will contact you.