Medicare Costs 2024

Medicare Part B premium and deductible costs have increased. Discover what Medicare costs in 2024.

SHARE THIS ARTICLE

Medicare Part B Costs

Medicare Part B costs, which cover your doctor and medical services, have increased. In 2024, you pay the following Part B costs:Part B Immunosuppressive Drug Coverage

After you pay the Medicare Part B deductible, you may receive the Part B immunosuppressive drug benefit. Starting last year (2023), beneficiaries whose full Medicare coverage ended 36 months after a kidney transplant can continue Part B immunosuppressive drug coverage. Beneficiaries must not have certain other types of insurance coverage and must pay the 2024 standard immunosuppressive drug premium of $103. However, premiums are higher for certain high-income beneficiaries. Specifically, qualifying beneficiaries who are married and filed a separate tax return. The table below shows the Part B Immunosuppressive Drug Premiums:

If you earned $103,000 or less in 2022 or $206,000 filing jointly, you pay the standard Part B premium of $174.70. However, beneficiaries who made more pay an additional monthly adjustment amount. The following 2024 Part B Premium charts show your Part B premium amounts.

Medicare Part A Costs

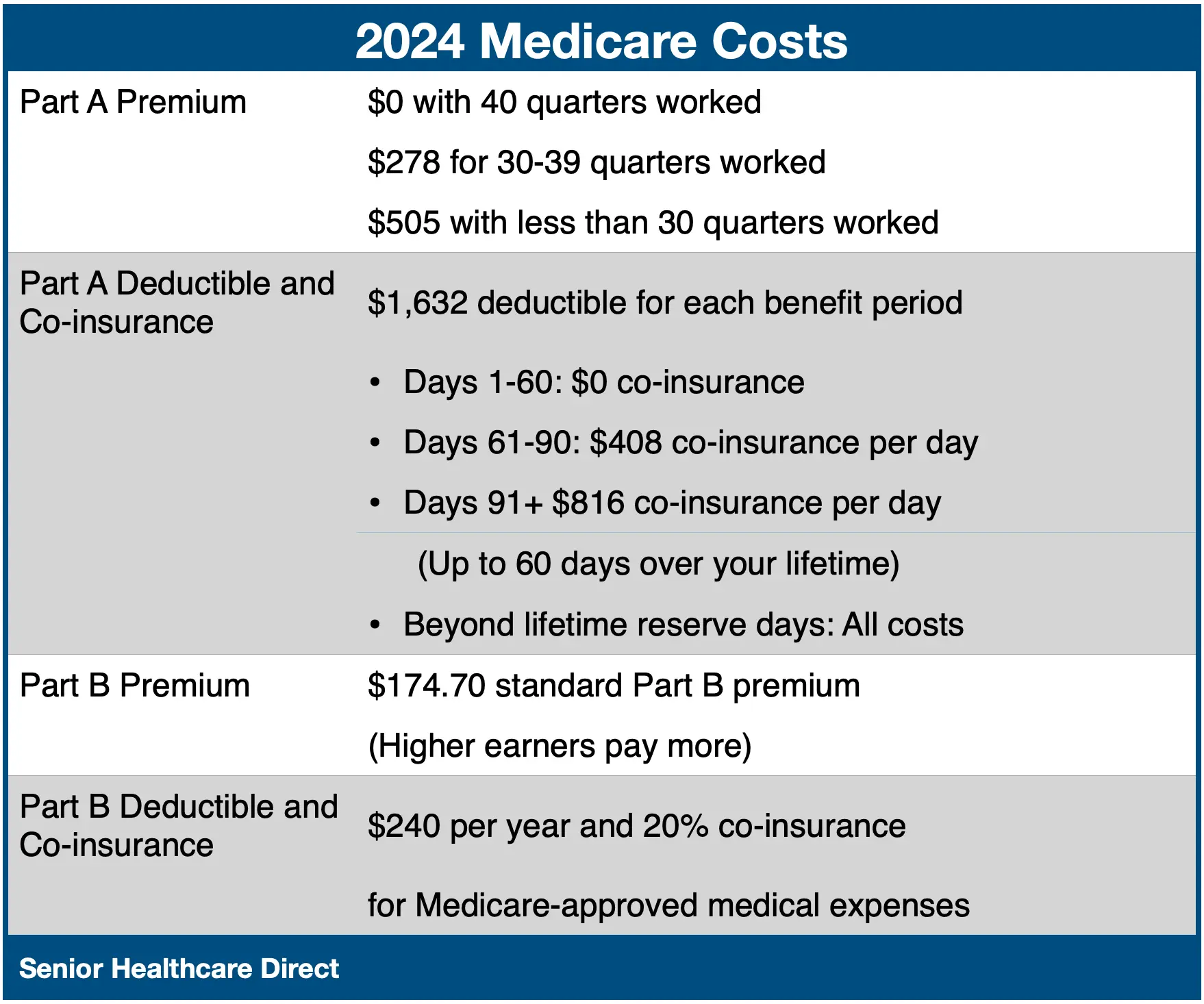

The 2024 Part A premium for beneficiaries who worked fewer than 30 quarters decreased by $1 to $505. For those who worked between 30 and 39 quarters, the 2024 Part A premium remained the same at $278.

The 2024 Part A hospital deductible has increased by $32 to $1,632. In addition, the Part A coinsurance amounts have also risen. Coinsurance costs rose $8 for hospital days 60 to 90, and you share the cost by paying $408 daily. Also, coinsurance rose $16 for hospital days over 90, so your daily cost share is $816.

The chart below summarizes your 2024 Medicare costs.

Medicare Part D Costs

Medicare Part D is outpatient prescription drug coverage for beneficiaries with Original Medicare Part A and/or Part B . In 2024, you can join 709 prescription drug plans (PDP) nationwide. You can enroll in a stand-alone PDP or Medicare Advantage plan that includes prescription drugs (MA-PD). Since prescription drug plans are provided by private insurance companies approved by the federal government, Part D costs and coverage may vary from plan to plan. The average monthly premium for all Medicare Advantage plans with prescription drug coverage (MA-PD) is projected to be $18.50 in 2024 . This is a small 64-cent increase from 2023.Part D Premiums for High-Income Earners

Beneficiaries who filed a 2022 individual tax return for more than $103,000 or a joint tax return for more than $206,000 will have a 2024 monthly adjustment on their Part D premium. The following charts show Medicare Part D Premiums Adjustments for 2024.

Share This Page: