What Is the Form 8959 Additional Medicare Tax for High-Income Earners?

Medicare beneficiaries earning a high income can download Form 8959 to file and pay the additional 0.9% tax. Learn whether you fall into this category.

SHARE THIS ARTICLE

If you’re a high-income earner on Medicare, you could owe additional taxes. Do you know what that threshold is for your particular situation?

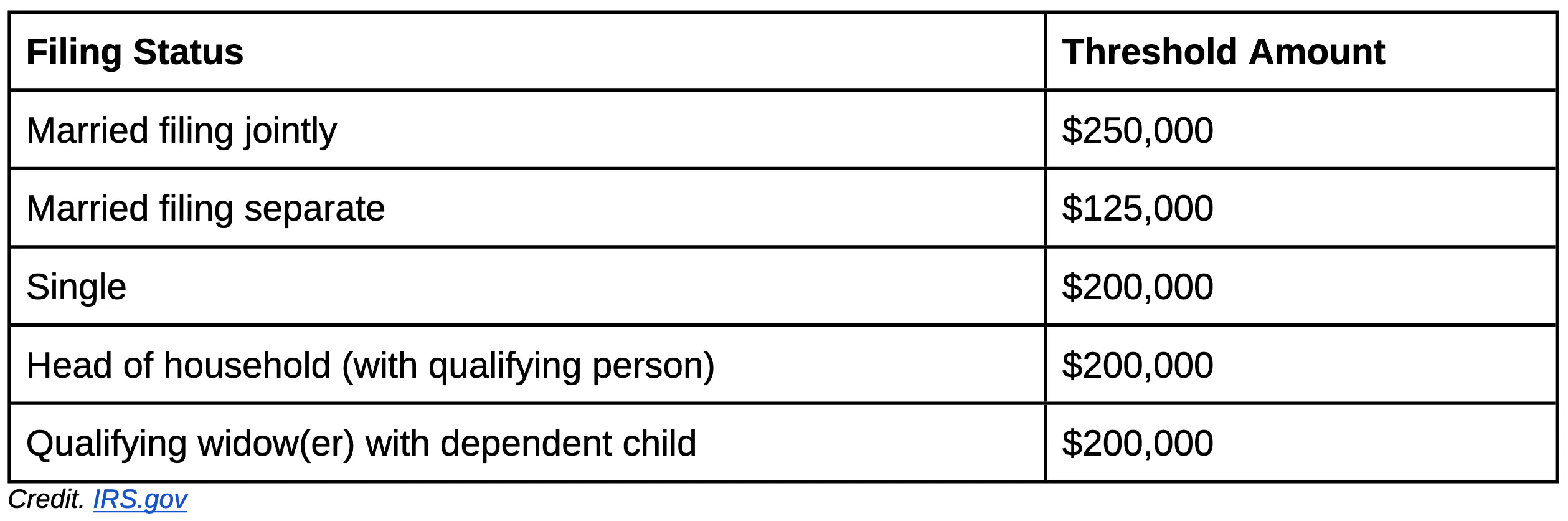

Starting in 2013, the Internal Revenue Service (IRS) implemented a 0.9% Additional Medicare Tax, applying to wages, Railroad Retirement Tax Act (RRTA) compensation and self-employment income above a specified threshold amount.

Given these threshold amounts, if you’re on Medicare and make this much money per year, you may need to file what the IRS calls Form 8959 (instructions and examples ).

You may need to file Form 8959 and pay more into Medicare if one or more of these stipulations apply to you:

Medicare wages and tips are greater than $200,000

RRTA compensation is greater than $200,000

Total Medicare wages and tips + self-employment income are greater than the

threshold amount. (This includes your spouse, if you’re married filing

jointly.)

Total RRTA compensation and tips are greater than the threshold amount. (This

also includes your spouse, if you’re married filing jointly.)

If any of this applies to you, you may need to pay an additional 0.9% to the IRS each year. You can ask your employer to withhold the extra amount from your paycheck, or payments can be made to the IRS throughout the year.

At tax time, you can easily download Form 8959 and attach it to your Form 1040. If your employer has withheld any Additional Medicare Tax throughout the year, you can report it on this form.

If you’re unsure whether you need to pay the Additional Medicare Tax, call 1-833-463-3262, TTY 711 to speak with a licensed agent at Senior Healthcare Direct. You can also get a quote.

Share This Page:

LEGAL DISCLAIMER: The above is meant to be strictly educational and not intended to provide medical advice or solicit the sales of an insurance product or service of any kind.

YM04012201