How Much Does Medicare Cost?

How much does Medicare cost, and how are Medicare costs calculated? The cost of Original Medicare includes premiums, deductibles, and coinsurance for Medicare Part A and Part B. Furthermore, you may have Medicare Part D prescription drug costs. Discover all your 2024 Medicare costs.

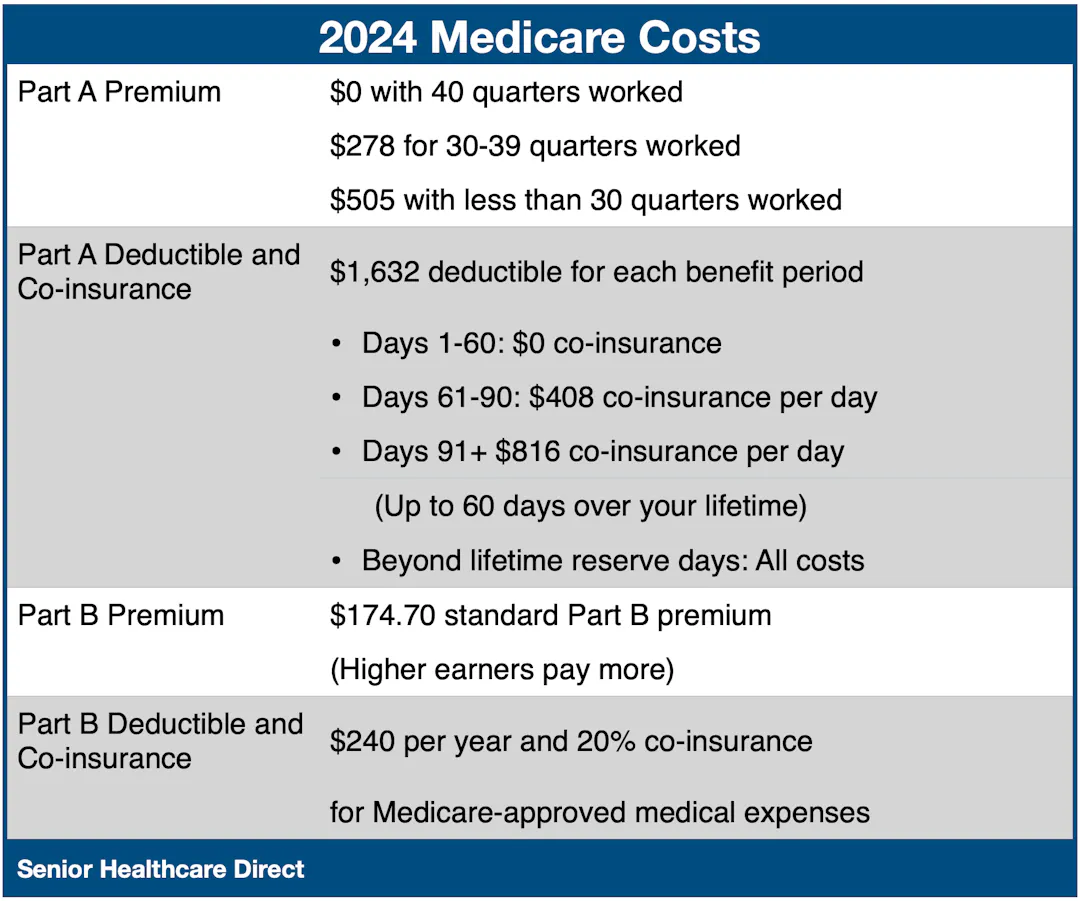

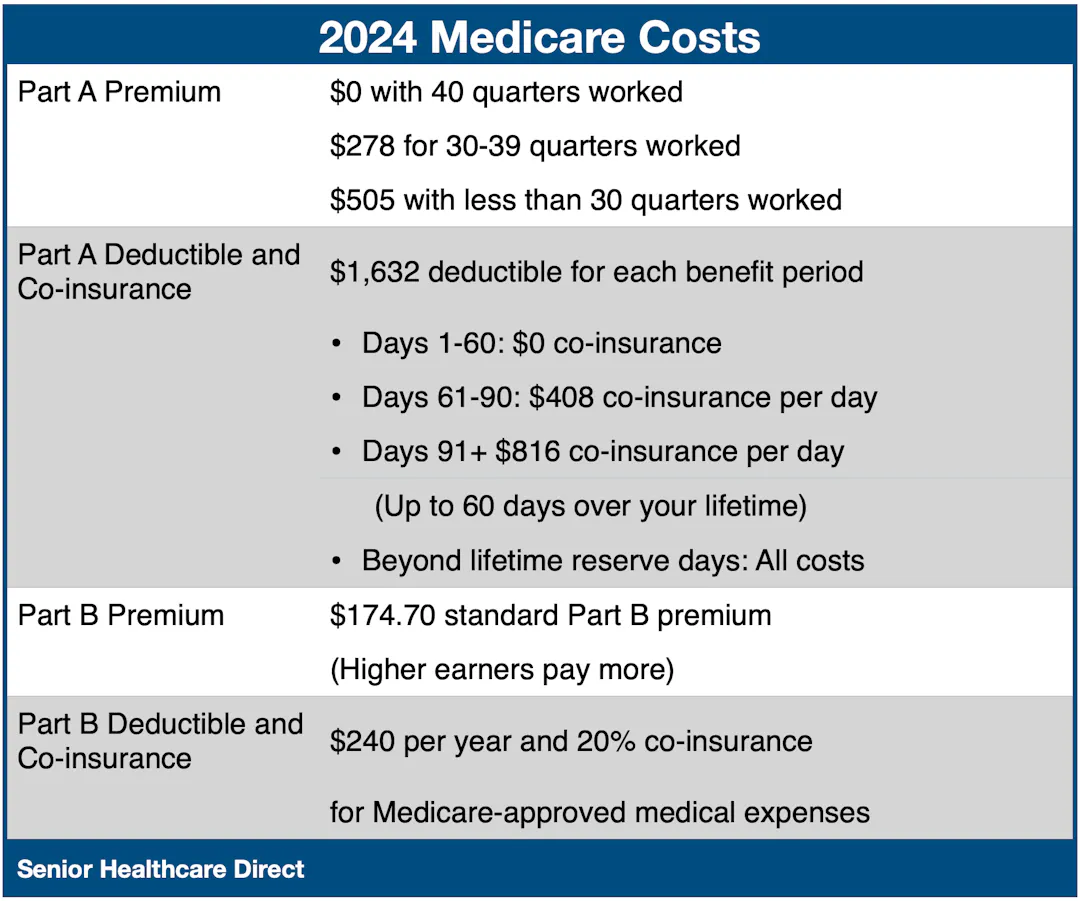

The premium cost of Medicare Part A depends on the number of quarters you worked. Most people have worked 40 quarters or more, so Part A premium cost is zero. The Part A deductible is $1,632 in 2024 for each benefit period of 60 days or less.

For example, you become a hospital inpatient on January 1, 2024, and pay a $1,632 deductible. Then, 60 days later, on March 2, 2024, a doctor admits you as a hospital inpatient, and you pay a $1,632 deductible again. Therefore, the worst case scenario is that a Medicare beneficiary goes in and out of the hospital six times in the year and pays a maximum $of 9,792 total in Part A deductibles.

To avoid the expensive cost of multiple hospitalizations, you could buy a Medicare Supplement Plan. Call Senior Healthcare Direct and speak with a licensed agent at 1-833-463-3262, TTY 711, or get your quote .

Medicare Part B covers the cost of ground ambulance transportation to a hospital or skilled nursing facility. In addition, Part B covers the cost of outpatient medical stays at any hospital or other facility for less than 24 hours. Furthermore, Medicare Part B covers the cost of preventive services such as your annual flu shot and wellness visit.

The standard Part B premium is $174.70 in 2024. However, high earners pay more.

The Part B deductible is $240 in 2024, and coinsurance is 20% of Medicare-approved medical costs.

Similar to Part B, Medicare Part D prescription drug costs varies based on income. If your tax return income in 2022 was $103,000 or less (either filed individually or filed married with a separate tax return) or $206,000 or less (if married and filed jointly), then you only pay your plan premium in 2024. The average monthly premium for Medicare Advantage plans with prescription drug coverage (MA-PD) is projected to be $18.50 in 2024 .

However, if your tax returns in 2022 were higher, you will pay more than the plan premium.

Medicare Part A Costs In 2024

The premium cost of Medicare Part A depends on the number of quarters you worked. Most people have worked 40 quarters or more, so Part A premium cost is zero. The Part A deductible is $1,632 in 2024 for each benefit period of 60 days or less.

For example, you become a hospital inpatient on January 1, 2024, and pay a $1,632 deductible. Then, 60 days later, on March 2, 2024, a doctor admits you as a hospital inpatient, and you pay a $1,632 deductible again. Therefore, the worst case scenario is that a Medicare beneficiary goes in and out of the hospital six times in the year and pays a maximum $of 9,792 total in Part A deductibles.

To avoid the expensive cost of multiple hospitalizations, you could buy a Medicare Supplement Plan. Call Senior Healthcare Direct and speak with a licensed agent at 1-833-463-3262, TTY 711, or get your quote .

Medicare Part B Costs In 2024

Medicare Part B covers the cost of ground ambulance transportation to a hospital or skilled nursing facility. In addition, Part B covers the cost of outpatient medical stays at any hospital or other facility for less than 24 hours. Furthermore, Medicare Part B covers the cost of preventive services such as your annual flu shot and wellness visit.

The standard Part B premium is $174.70 in 2024. However, high earners pay more.

The Part B deductible is $240 in 2024, and coinsurance is 20% of Medicare-approved medical costs.

Medicare Part D Costs In 2024

Similar to Part B, Medicare Part D prescription drug costs varies based on income. If your tax return income in 2022 was $103,000 or less (either filed individually or filed married with a separate tax return) or $206,000 or less (if married and filed jointly), then you only pay your plan premium in 2024. The average monthly premium for Medicare Advantage plans with prescription drug coverage (MA-PD) is projected to be $18.50 in 2024 .

However, if your tax returns in 2022 were higher, you will pay more than the plan premium.

Hospital Copay Costs

Medicare Part A copays are $0 for the first 60 days of inpatient hospitalization. However, copay costs for days 61 through 90 are $408 per day in 2024. In other words, the copay cost for these 30 days is $12,240. Discover all Part A hospital costs in 2024.

You can avoid these expensive out-of-pocket costs when you buy a Medigap Plan such as Plan G.

Skilled Nursing Costs

Skilled Nursing Facility copayment costs are $0 in 2024 for the first 20 days. However, the copay cost for days 21 to 100 is $200 per day. Your share of Medicare costs during these 80 days in a skilled nursing facility totals $16,000. Furthermore, after 100 days, you are responsible for all skilled nursing facility costs. Learn more about Medicare coverage at a Skilled Nursing Facility.

How Much Does Medicare Cost You?

Please use the Medicare Part B Premiums for 2024 chart to determine your monthly cost. The annual Part B deductible is $240 in 2024. After you pay the Medicare deductible, you may owe 20% coinsurance.

Since there is no limit or cap on your 20% coinsurance, it can add up to thousands of dollars. You can avoid unlimited coinsurance expenses by getting a Medicare Supplement Plan. Then, you can have a fixed healthcare cost no matter how often you need medical services.

Common Questions About Medicare

How Do I Sign Up For Medicare Part A Only?

When you enroll in Medicare you sign up for Part A. However, Medicare Parts B, C, and D are optional so you can delay enrollment without penalty if you have credible coverage.

How To Sign Up For Medicare Part B?

You can apply for Medicare Part B by filling out an online application at SSA.org, calling Social Security at 1-800-772-1213, TTY 711, or visiting your local Social Security office.

How To Sign Up For Medicare Part D?

Senior Healthcare Direct’s licensed agents can help you understand the ins and outs of various Medicare plans. Talk to us to get information on Medicare costs, from initial premiums to Medicare out-of-pocket maximum charges, as well as to figure out what’s the best plan for your circumstances. If you’re interested in learning more about Medicare Part A, Part B, and/or Part D, reach out to us. Please enter your information below and a licensed agent will contact you.

B03082301