New to Medicare? Start by Comparing Medigap Plans

By comparing Medigap plans you can find the supplement plans with the coverage benefits you need.

SHARE THIS ARTICLE

Medigap Plans C and F

Since January 1, 2020, Medigap plans C and F have gone away for beneficiaries new to Medicare. However, those who have Medicare Supplement Plans C or F or were covered by one of these plans before January 1, 2020, can keep either Medigap plan.

Comparing Medigap Plans: F, G and N

Let’s break down some more important points specific to popular Medigap plans, and then we’ll lay out each Medigap plan to compare side-by-side.

While Medigap Plan F has been discontinued for those new to Medicare as of 2020, it remains one of the more popular Medigap plans. That being said, Plan G is exactly the same as Plan F — except for one thing: whereas Plan F covers the Medicare Part B annual deductible, Plan G does not. But once that deductible is met, Plan G covers everything Plan F does, and it doesso at a greater value.

The next-most popular Medigap policy, Plan N, is a lower-cost alternative to Plan G. However, Plan N does not cover Part B excess charges. Medigap Plan N may also have copayment costs.

Medigap plans G or N both provide the most comprehensive benefits available for beneficiaries new to Medicare.

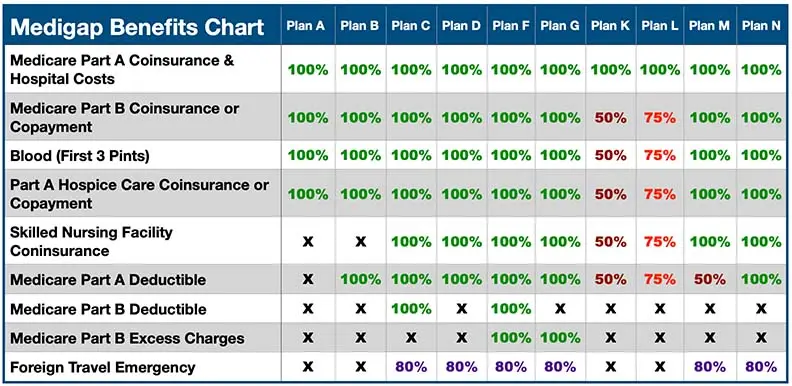

The table below allows you to view all Medigap plans side-by-side to decide which is best for you. In this table, “Yes” means the plan covers 100% of the benefit, whereas “No” means the benefit is not covered. A % amount shows what percentage of this benefit is covered.

NOTE: Medigap covers coinsurance after you’ve paid the deductible, unless your chosen Medigap policy also covers the deductible.

Interested in learning more about what Medigap plan is right for you? Call Senior Healthcare Direct today at 1-833-463-3262, TTY 711 to speak with a licensed agent. Or get your quote, and a licensed agent will contact you.

Share This Page:

LEGAL DISCLAIMER: The above is meant to be strictly educational and not intended to provide medical advice or solicit the sales of an insurance product or service of any kind.